Buying a home represents one of the biggest financial commitments most Americans will make in their lifetime. For millennials navigating today’s competitive housing market, understanding what lenders scrutinize during the mortgage approval process can mean the difference between getting the keys to your dream home or facing another rejection. The mortgage landscape has evolved significantly in recent years, with digital tools and fintech solutions streamlining applications while regulatory requirements continue to protect both borrowers and lenders. Yet despite these technological advances, the fundamental criteria that determine approval remain surprisingly consistent. Lenders still focus on key financial indicators that demonstrate your ability to repay the loan. This article breaks down the essential elements lenders evaluate, helping you prepare for a smoother application experience and increasing your chances of hearing that coveted “yes.”

Your Credit Score: The First Thing Lenders See

Your credit score serves as your financial report card, and lenders examine it closely before making any lending decisions. This three-digit number, typically ranging from 300 to 850, provides lenders with a snapshot of your creditworthiness based on your borrowing history. Most conventional mortgage lenders prefer scores of 620 or higher, though many competitive rates require scores above 740. FHA loans offer more flexibility, sometimes accepting scores as low as 580 with a 3.5% down payment, making homeownership accessible to borrowers still building their credit profiles.

The way lenders use your credit score has become more sophisticated with digital transformation in the financial sector. Modern underwriting systems can instantly pull your credit data from all three major bureaus—Equifax, Experian, and TransUnion—and calculate risk assessments within seconds. These automated systems flag potential issues like recent late payments, high credit utilization, or collections accounts that might concern underwriters. Fintech innovations have also introduced alternative credit scoring models that consider factors beyond traditional metrics, potentially helping millennials with limited credit histories but strong financial habits.

Understanding what impacts your score empowers you to improve it before applying. Payment history accounts for roughly 35% of your score, making on-time payments crucial. Credit utilization—how much of your available credit you’re using—makes up about 30%. Lenders view high utilization as a red flag, even if you pay balances monthly. Length of credit history, types of credit accounts, and recent credit inquiries round out the remaining factors. You should check your credit reports at least three to six months before applying for a mortgage, giving yourself time to dispute errors or address legitimate concerns that could derail your application.

How Credit Impacts Your Interest Rate

Beyond approval, your credit score directly influences the interest rate lenders offer you. Even a difference of 20 to 40 points can cost thousands over the life of your loan. Borrowers with excellent credit (760+) typically receive the lowest rates available, while those with fair credit (620-679) might pay significantly higher rates to compensate lenders for increased risk. According to data from major lenders, a 0.5% difference in interest rate on a $300,000 mortgage can result in over $35,000 in additional interest payments over 30 years.

Income Verification and Employment Stability

Lenders need confidence that you can afford your monthly mortgage payments, which makes income verification a critical component of the approval process. You’ll need to provide documentation proving your income, typically including recent pay stubs, W-2 forms from the past two years, and sometimes tax returns if you’re self-employed or have additional income sources. The digital age has streamlined this process considerably—many lenders now use automated verification services that connect directly with employers or tax databases, reducing paperwork and speeding up approval timelines.

Employment stability matters just as much as income amount. Lenders typically prefer to see at least two years of consistent employment, ideally in the same field or with a clear career progression. Frequent job changes might raise concerns about income reliability, though legitimate reasons like career advancement or industry shifts can be explained. The gig economy presents unique challenges for millennial borrowers who cobble together income from multiple sources. Lenders have adapted by developing guidelines for evaluating freelance, contract, and platform-based income, though requirements often include longer documentation periods and higher credit standards.

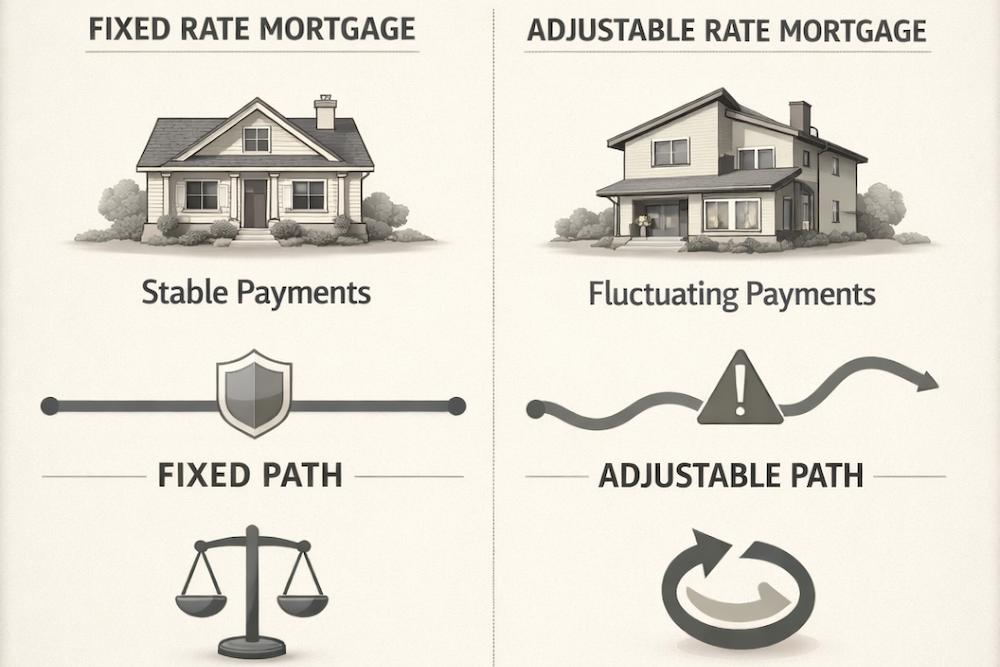

Your debt-to-income ratio (DTI) combines your income with existing debt obligations to determine affordability. Lenders calculate DTI by dividing your total monthly debt payments by your gross monthly income. Most conventional loans require a DTI below 43%, though some programs allow higher ratios with compensating factors like excellent credit or substantial cash reserves. This metric explains why paying down existing debts before applying for a mortgage can significantly improve your approval odds and the loan amount you qualify for.

Self-Employment and Alternative Income

Self-employed millennials and those with non-traditional income sources face additional scrutiny during the mortgage process. Lenders typically require two years of tax returns to verify self-employment income, and they often average your income over this period to account for fluctuations. Business owners who write off significant expenses might discover their qualifying income appears lower than expected, since lenders use adjusted gross income rather than revenue. Recent regulatory changes have pushed some lenders to develop specialized programs for gig workers and freelancers, recognizing that traditional employment verification methods don’t fit modern work arrangements.

The Importance of Documentation

Today’s mortgage landscape demands thorough documentation, even as digital tools make submission easier. You should organize financial documents before starting your application, including bank statements showing consistent deposits, proof of any additional income like bonuses or investment returns, and explanations for any unusual deposits or withdrawals. Lenders scrutinize large deposits particularly carefully, as they need to verify these funds don’t represent borrowed money that would increase your debt obligations. The rise of digital banking and fintech solutions means lenders can verify account balances and transaction histories more quickly, but you still bear responsibility for explaining anything that appears irregular.

Gift funds from family members have become increasingly common as millennials struggle with down payment requirements in expensive markets. Lenders accept gift funds but require documentation proving the money is truly a gift rather than a loan. Donors typically must provide a gift letter stating they expect no repayment and documentation showing the transfer of funds. Some innovative fintech platforms now offer down payment assistance programs or crowdfunding options, though these require careful navigation of lender requirements and regulations designed to prevent predatory lending practices.

Securing mortgage approval doesn’t have to feel like an insurmountable obstacle, even in today’s complex lending environment. By understanding what lenders prioritize—your credit score, income stability, and documentation—you can take proactive steps to strengthen your application before submitting it. The integration of digital tools and fintech solutions has made the process faster and more transparent than ever, though the fundamental principles of responsible lending remain unchanged. Start by checking your credit, organizing your financial documents, and honestly assessing your debt-to-income ratio. If you identify weak spots, give yourself time to address them before applying. Remember that lenders want to approve qualified borrowers; their success depends on making good loans. By presenting yourself as a reliable borrower with stable income and responsible credit management, you position yourself for that “yes” that opens the door to homeownership. The journey might seem daunting, but preparation and understanding of these mortgage approval basics will serve you well throughout the process.

References

- Consumer Financial Protection Bureau. “What is a debt-to-income ratio? Why is the 43% debt-to-income ratio important?” CFPB. https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-to-income-ratio-why-is-the-43-debt-to-income-ratio-important-en-1791/

- Experian. “What Credit Score Do You Need to Buy a House?” Experian. https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-credit-score-do-you-need-to-buy-a-house/

- NerdWallet. “How to Verify Income for a Mortgage: What Lenders Look For.” NerdWallet. https://www.nerdwallet.com/article/mortgages/verify-income-mortgage

Buying a home represents one of the biggest financial commitments most Americans will make in their lifetime. For millennials navigating today’s competitive housing market, understanding what lenders scrutinize during the mortgage approval process can mean the difference between getting the keys to your dream home or facing another rejection. The mortgage landscape has evolved significantly in recent years, with digital tools and fintech solutions streamlining applications while regulatory requirements continue to protect both borrowers and lenders. Yet despite these technological advances, the fundamental criteria that determine approval remain surprisingly consistent. Lenders still focus on key financial indicators that demonstrate your ability to repay the loan. This article breaks down the essential elements lenders evaluate, helping you prepare for a smoother application experience and increasing your chances of hearing that coveted “yes.”

Your Credit Score: The First Thing Lenders See

Your credit score serves as your financial report card, and lenders examine it closely before making any lending decisions. This three-digit number, typically ranging from 300 to 850, provides lenders with a snapshot of your creditworthiness based on your borrowing history. Most conventional mortgage lenders prefer scores of 620 or higher, though many competitive rates require scores above 740. FHA loans offer more flexibility, sometimes accepting scores as low as 580 with a 3.5% down payment, making homeownership accessible to borrowers still building their credit profiles.

The way lenders use your credit score has become more sophisticated with digital transformation in the financial sector. Modern underwriting systems can instantly pull your credit data from all three major bureaus—Equifax, Experian, and TransUnion—and calculate risk assessments within seconds. These automated systems flag potential issues like recent late payments, high credit utilization, or collections accounts that might concern underwriters. Fintech innovations have also introduced alternative credit scoring models that consider factors beyond traditional metrics, potentially helping millennials with limited credit histories but strong financial habits.

Understanding what impacts your score empowers you to improve it before applying. Payment history accounts for roughly 35% of your score, making on-time payments crucial. Credit utilization—how much of your available credit you’re using—makes up about 30%. Lenders view high utilization as a red flag, even if you pay balances monthly. Length of credit history, types of credit accounts, and recent credit inquiries round out the remaining factors. You should check your credit reports at least three to six months before applying for a mortgage, giving yourself time to dispute errors or address legitimate concerns that could derail your application.

How Credit Impacts Your Interest Rate

Beyond approval, your credit score directly influences the interest rate lenders offer you. Even a difference of 20 to 40 points can cost thousands over the life of your loan. Borrowers with excellent credit (760+) typically receive the lowest rates available, while those with fair credit (620-679) might pay significantly higher rates to compensate lenders for increased risk. According to data from major lenders, a 0.5% difference in interest rate on a $300,000 mortgage can result in over $35,000 in additional interest payments over 30 years.

Income Verification and Employment Stability

Lenders need confidence that you can afford your monthly mortgage payments, which makes income verification a critical component of the approval process. You’ll need to provide documentation proving your income, typically including recent pay stubs, W-2 forms from the past two years, and sometimes tax returns if you’re self-employed or have additional income sources. The digital age has streamlined this process considerably—many lenders now use automated verification services that connect directly with employers or tax databases, reducing paperwork and speeding up approval timelines.

Employment stability matters just as much as income amount. Lenders typically prefer to see at least two years of consistent employment, ideally in the same field or with a clear career progression. Frequent job changes might raise concerns about income reliability, though legitimate reasons like career advancement or industry shifts can be explained. The gig economy presents unique challenges for millennial borrowers who cobble together income from multiple sources. Lenders have adapted by developing guidelines for evaluating freelance, contract, and platform-based income, though requirements often include longer documentation periods and higher credit standards.

Your debt-to-income ratio (DTI) combines your income with existing debt obligations to determine affordability. Lenders calculate DTI by dividing your total monthly debt payments by your gross monthly income. Most conventional loans require a DTI below 43%, though some programs allow higher ratios with compensating factors like excellent credit or substantial cash reserves. This metric explains why paying down existing debts before applying for a mortgage can significantly improve your approval odds and the loan amount you qualify for.

Self-Employment and Alternative Income

Self-employed millennials and those with non-traditional income sources face additional scrutiny during the mortgage process. Lenders typically require two years of tax returns to verify self-employment income, and they often average your income over this period to account for fluctuations. Business owners who write off significant expenses might discover their qualifying income appears lower than expected, since lenders use adjusted gross income rather than revenue. Recent regulatory changes have pushed some lenders to develop specialized programs for gig workers and freelancers, recognizing that traditional employment verification methods don’t fit modern work arrangements.

The Importance of Documentation

Today’s mortgage landscape demands thorough documentation, even as digital tools make submission easier. You should organize financial documents before starting your application, including bank statements showing consistent deposits, proof of any additional income like bonuses or investment returns, and explanations for any unusual deposits or withdrawals. Lenders scrutinize large deposits particularly carefully, as they need to verify these funds don’t represent borrowed money that would increase your debt obligations. The rise of digital banking and fintech solutions means lenders can verify account balances and transaction histories more quickly, but you still bear responsibility for explaining anything that appears irregular.

Gift funds from family members have become increasingly common as millennials struggle with down payment requirements in expensive markets. Lenders accept gift funds but require documentation proving the money is truly a gift rather than a loan. Donors typically must provide a gift letter stating they expect no repayment and documentation showing the transfer of funds. Some innovative fintech platforms now offer down payment assistance programs or crowdfunding options, though these require careful navigation of lender requirements and regulations designed to prevent predatory lending practices.

Securing mortgage approval doesn’t have to feel like an insurmountable obstacle, even in today’s complex lending environment. By understanding what lenders prioritize—your credit score, income stability, and documentation—you can take proactive steps to strengthen your application before submitting it. The integration of digital tools and fintech solutions has made the process faster and more transparent than ever, though the fundamental principles of responsible lending remain unchanged. Start by checking your credit, organizing your financial documents, and honestly assessing your debt-to-income ratio. If you identify weak spots, give yourself time to address them before applying. Remember that lenders want to approve qualified borrowers; their success depends on making good loans. By presenting yourself as a reliable borrower with stable income and responsible credit management, you position yourself for that “yes” that opens the door to homeownership. The journey might seem daunting, but preparation and understanding of these mortgage approval basics will serve you well throughout the process.

References

- Consumer Financial Protection Bureau. “What is a debt-to-income ratio? Why is the 43% debt-to-income ratio important?” CFPB. https://www.consumerfinance.gov/ask-cfpb/what-is-a-debt-to-income-ratio-why-is-the-43-debt-to-income-ratio-important-en-1791/

- Experian. “What Credit Score Do You Need to Buy a House?” Experian. https://www.experian.com/blogs/ask-experian/credit-education/score-basics/what-credit-score-do-you-need-to-buy-a-house/

- NerdWallet. “How to Verify Income for a Mortgage: What Lenders Look For.” NerdWallet. https://www.nerdwallet.com/article/mortgages/verify-income-mortgage