Personal loans have become a go-to financial tool for millions of Americans navigating everything from debt consolidation to emergency expenses. The personal loan market has exploded in recent years, fueled by fintech innovation and digital lending platforms that promise approval in minutes. But here’s the thing: just because you can borrow doesn’t mean you should.

Understanding when a personal loan serves as a strategic financial move versus when it becomes a costly mistake can make the difference between building your financial future and sabotaging it. This guide breaks down the real scenarios where personal loans shine and the hidden pitfalls that can drain your bank account faster than you realize.

When Personal Loans Work in Your Favor

Personal loans truly shine when you’re drowning in credit card debt. Credit cards typically charge interest rates between 18% and 24%, while personal loans often offer rates as low as 6% to 12% for borrowers with good credit. The math is simple: borrowing at a lower rate to pay off higher-rate debt saves you money. You also simplify your financial life by replacing multiple payments with a single monthly obligation.

The psychological benefit matters too. Watching multiple credit card balances slowly decrease can feel overwhelming and demotivating. A personal loan gives you a clear roadmap with a fixed end date. You know exactly when you’ll be debt-free, which helps you stay committed to the payoff plan.

However, this strategy only works if you address the underlying spending habits that created the credit card debt in the first place. Taking out a personal loan to consolidate debt while continuing to rack up new credit card charges puts you in an even worse position. Financial experts at NerdWallet emphasize that successful debt consolidation requires both the loan and a commitment to changed behavior.

Financing Major Life Events

Sometimes personal loans make perfect sense for planned, one-time expenses with clear returns. Medical procedures not covered by insurance, home repairs that prevent larger damage, or even wedding expenses can justify borrowing if you’ve exhausted savings options. The key is that these expenses are necessary, time-sensitive, and won’t recur monthly.

Education and career development represent another smart use case. If a certification course or professional training will directly increase your earning potential, a personal loan can function as an investment in yourself. The return on investment becomes tangible when your salary increases or new job opportunities open up.

Emergency situations also warrant consideration. When your car breaks down and you need it for work, or your HVAC system dies in the middle of summer, a personal loan beats alternatives like payday loans or high-interest credit cards. The emergency must be genuine, though. That spontaneous vacation to Bali doesn’t qualify, no matter how much you need a break.

Building Credit Through Strategic Borrowing

Personal loans can actually improve your credit score when managed properly. They add to your credit mix, which accounts for 10% of your FICO score. If you’ve only had revolving credit like credit cards, adding an installment loan diversifies your credit profile.

Making consistent, on-time payments builds your payment history, the single most important factor in your credit score. This benefit extends beyond just the score itself. Future lenders see a track record of responsible borrowing, which can unlock better rates on mortgages and auto loans down the line.

The catch? This only works if you actually make those payments on time. A single missed payment can tank your score and negate any benefits. You must have stable income and a realistic budget before using a personal loan as a credit-building tool.

The Hidden Costs That Drain Your Wallet

The advertised interest rate rarely tells the whole story. Origination fees typically range from 1% to 8% of the loan amount, and lenders often deduct this fee from your loan proceeds. Borrow $10,000 with a 5% origination fee, and you only receive $9,500—but you still owe $10,000 plus interest.

Late payment fees add another layer of cost. Miss a payment, and you might face charges of $25 to $50, plus potential penalty interest rate increases. Some lenders also charge prepayment penalties if you pay off your loan early, which seems counterintuitive but protects their profit margins.

Administrative fees, check processing fees, and “insurance” products get bundled into loan agreements. These extras can add hundreds or even thousands to your total repayment amount. The Consumer Financial Protection Bureau has increased scrutiny on these practices, but borrowers still need to read the fine print carefully.

The Interest Rate Trap for Average Credit

Marketing materials showcase those attractive low rates, but qualifying for them requires excellent credit. The median personal loan rate for borrowers with fair credit hovers around 18% to 24%, according to recent data from Experian. At those rates, you’re barely better off than using a credit card.

Many online lenders use a “rate range” advertising strategy that’s technically truthful but misleading. They advertise rates “as low as” 5.99%, but the average approved borrower gets something closer to 16%. You won’t know your actual rate until after a hard credit inquiry, which temporarily dings your score.

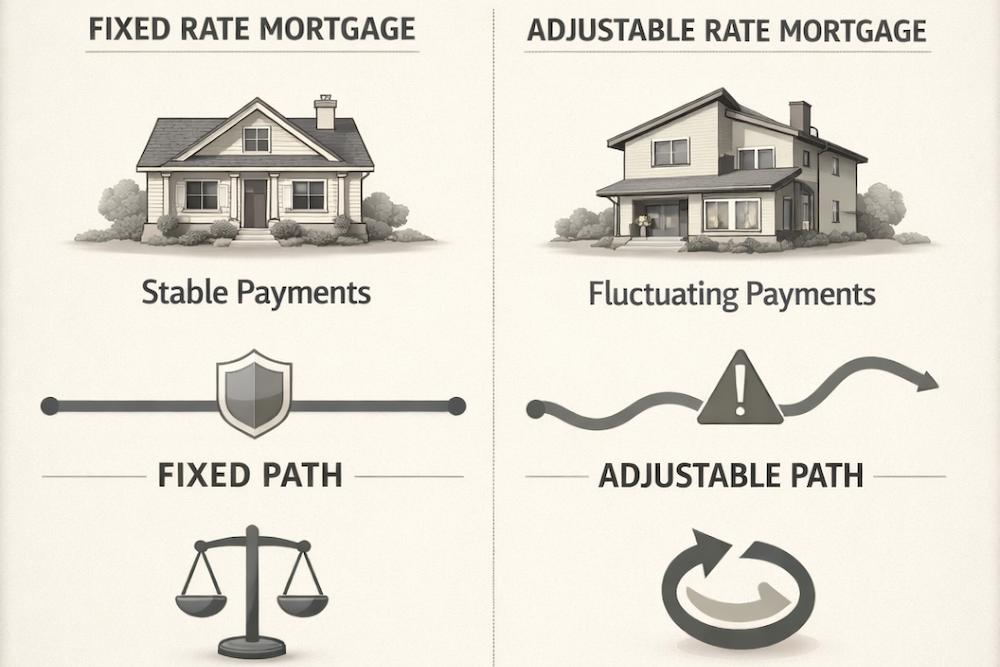

Variable rate loans present another risk. Your rate might start competitively but can increase based on market conditions. In a rising interest rate environment like we’ve seen recently, your monthly payment could jump significantly, straining your budget unexpectedly.

When Borrowing Becomes a Band-Aid

Personal loans become dangerous when you use them to maintain a lifestyle you can’t actually afford. Borrowing to cover regular monthly expenses like rent, groceries, or utility bills indicates a fundamental income problem that debt only postpones. The loan eventually comes due, and you’re left in a worse position than before.

The debt cycle trap catches many borrowers off guard. You take a personal loan to solve a financial crunch, but the new monthly payment creates another crunch. So you borrow again, layering debt upon debt until the situation becomes unmanageable. This pattern has become more common as digital lending platforms make borrowing almost frictionless.

Fintech innovations have democratized access to credit, which brings both benefits and risks. The speed and convenience of app-based lending removes the natural cooling-off period that traditional bank loans provided. You can make an impulsive borrowing decision at 2 AM without speaking to a human who might ask tough questions about whether the loan makes sense for your situation.

Personal loans aren’t inherently good or bad—they’re tools that deliver different outcomes depending on how you use them. The best borrowing decisions start with honest self-assessment about your financial situation and discipline. Can you afford the monthly payment without sacrificing other financial priorities? Does the loan solve a specific problem with a clear benefit? Have you explored alternatives like building an emergency fund or negotiating payment plans?

In today’s digital lending landscape, accessing credit has never been easier, but that convenience demands more responsibility from borrowers, not less. Make informed decisions, read every word of your loan agreement, and remember that the best loan is often the one you don’t take.

References

- NerdWallet. (2024). “Personal Loans: Compare Rates & Apply Online.” https://www.nerdwallet.com/best/loans/personal-loans

- Experian. (2024). “What Is a Good Interest Rate for a Personal Loan?” https://www.experian.com/blogs/ask-experian/what-is-a-good-interest-rate-for-a-personal-loan/

- Consumer Financial Protection Bureau. (2024). “What is a personal loan?” https://www.consumerfinance.gov/ask-cfpb/what-is-a-personal-loan-en-1997/

Personal loans have become a go-to financial tool for millions of Americans navigating everything from debt consolidation to emergency expenses. The personal loan market has exploded in recent years, fueled by fintech innovation and digital lending platforms that promise approval in minutes. But here’s the thing: just because you can borrow doesn’t mean you should.

Understanding when a personal loan serves as a strategic financial move versus when it becomes a costly mistake can make the difference between building your financial future and sabotaging it. This guide breaks down the real scenarios where personal loans shine and the hidden pitfalls that can drain your bank account faster than you realize.

When Personal Loans Work in Your Favor

Personal loans truly shine when you’re drowning in credit card debt. Credit cards typically charge interest rates between 18% and 24%, while personal loans often offer rates as low as 6% to 12% for borrowers with good credit. The math is simple: borrowing at a lower rate to pay off higher-rate debt saves you money. You also simplify your financial life by replacing multiple payments with a single monthly obligation.

The psychological benefit matters too. Watching multiple credit card balances slowly decrease can feel overwhelming and demotivating. A personal loan gives you a clear roadmap with a fixed end date. You know exactly when you’ll be debt-free, which helps you stay committed to the payoff plan.

However, this strategy only works if you address the underlying spending habits that created the credit card debt in the first place. Taking out a personal loan to consolidate debt while continuing to rack up new credit card charges puts you in an even worse position. Financial experts at NerdWallet emphasize that successful debt consolidation requires both the loan and a commitment to changed behavior.

Financing Major Life Events

Sometimes personal loans make perfect sense for planned, one-time expenses with clear returns. Medical procedures not covered by insurance, home repairs that prevent larger damage, or even wedding expenses can justify borrowing if you’ve exhausted savings options. The key is that these expenses are necessary, time-sensitive, and won’t recur monthly.

Education and career development represent another smart use case. If a certification course or professional training will directly increase your earning potential, a personal loan can function as an investment in yourself. The return on investment becomes tangible when your salary increases or new job opportunities open up.

Emergency situations also warrant consideration. When your car breaks down and you need it for work, or your HVAC system dies in the middle of summer, a personal loan beats alternatives like payday loans or high-interest credit cards. The emergency must be genuine, though. That spontaneous vacation to Bali doesn’t qualify, no matter how much you need a break.

Building Credit Through Strategic Borrowing

Personal loans can actually improve your credit score when managed properly. They add to your credit mix, which accounts for 10% of your FICO score. If you’ve only had revolving credit like credit cards, adding an installment loan diversifies your credit profile.

Making consistent, on-time payments builds your payment history, the single most important factor in your credit score. This benefit extends beyond just the score itself. Future lenders see a track record of responsible borrowing, which can unlock better rates on mortgages and auto loans down the line.

The catch? This only works if you actually make those payments on time. A single missed payment can tank your score and negate any benefits. You must have stable income and a realistic budget before using a personal loan as a credit-building tool.

The Hidden Costs That Drain Your Wallet

The advertised interest rate rarely tells the whole story. Origination fees typically range from 1% to 8% of the loan amount, and lenders often deduct this fee from your loan proceeds. Borrow $10,000 with a 5% origination fee, and you only receive $9,500—but you still owe $10,000 plus interest.

Late payment fees add another layer of cost. Miss a payment, and you might face charges of $25 to $50, plus potential penalty interest rate increases. Some lenders also charge prepayment penalties if you pay off your loan early, which seems counterintuitive but protects their profit margins.

Administrative fees, check processing fees, and “insurance” products get bundled into loan agreements. These extras can add hundreds or even thousands to your total repayment amount. The Consumer Financial Protection Bureau has increased scrutiny on these practices, but borrowers still need to read the fine print carefully.

The Interest Rate Trap for Average Credit

Marketing materials showcase those attractive low rates, but qualifying for them requires excellent credit. The median personal loan rate for borrowers with fair credit hovers around 18% to 24%, according to recent data from Experian. At those rates, you’re barely better off than using a credit card.

Many online lenders use a “rate range” advertising strategy that’s technically truthful but misleading. They advertise rates “as low as” 5.99%, but the average approved borrower gets something closer to 16%. You won’t know your actual rate until after a hard credit inquiry, which temporarily dings your score.

Variable rate loans present another risk. Your rate might start competitively but can increase based on market conditions. In a rising interest rate environment like we’ve seen recently, your monthly payment could jump significantly, straining your budget unexpectedly.

When Borrowing Becomes a Band-Aid

Personal loans become dangerous when you use them to maintain a lifestyle you can’t actually afford. Borrowing to cover regular monthly expenses like rent, groceries, or utility bills indicates a fundamental income problem that debt only postpones. The loan eventually comes due, and you’re left in a worse position than before.

The debt cycle trap catches many borrowers off guard. You take a personal loan to solve a financial crunch, but the new monthly payment creates another crunch. So you borrow again, layering debt upon debt until the situation becomes unmanageable. This pattern has become more common as digital lending platforms make borrowing almost frictionless.

Fintech innovations have democratized access to credit, which brings both benefits and risks. The speed and convenience of app-based lending removes the natural cooling-off period that traditional bank loans provided. You can make an impulsive borrowing decision at 2 AM without speaking to a human who might ask tough questions about whether the loan makes sense for your situation.

Personal loans aren’t inherently good or bad—they’re tools that deliver different outcomes depending on how you use them. The best borrowing decisions start with honest self-assessment about your financial situation and discipline. Can you afford the monthly payment without sacrificing other financial priorities? Does the loan solve a specific problem with a clear benefit? Have you explored alternatives like building an emergency fund or negotiating payment plans?

In today’s digital lending landscape, accessing credit has never been easier, but that convenience demands more responsibility from borrowers, not less. Make informed decisions, read every word of your loan agreement, and remember that the best loan is often the one you don’t take.

References

- NerdWallet. (2024). “Personal Loans: Compare Rates & Apply Online.” https://www.nerdwallet.com/best/loans/personal-loans

- Experian. (2024). “What Is a Good Interest Rate for a Personal Loan?” https://www.experian.com/blogs/ask-experian/what-is-a-good-interest-rate-for-a-personal-loan/

- Consumer Financial Protection Bureau. (2024). “What is a personal loan?” https://www.consumerfinance.gov/ask-cfpb/what-is-a-personal-loan-en-1997/