You open your mailbox and your stomach drops. Another stack of bills awaits. Meanwhile, your checking account balance tells a different story—one where your paycheck disappeared days ago. If this scenario sounds familiar, you’re not alone. A 2023 LendingClub report found that 60% of Americans live paycheck to paycheck, struggling to keep up with mounting expenses. The gap between income and obligations has widened significantly, especially as inflation drives up costs for everything from groceries to rent. But falling behind doesn’t mean you’re out of options. Strategic planning and smart resource allocation can help you regain control of your finances, even when the numbers don’t seem to add up.

Take Control: Prioritize Your Bills Strategically

When money runs short, not all bills deserve equal attention. Financial experts recommend the “four walls” approach: food, shelter, utilities, and transportation. These essentials keep you alive, housed, and able to work. Everything else comes second. This might sound harsh, but prioritization becomes crucial when resources dwindle.

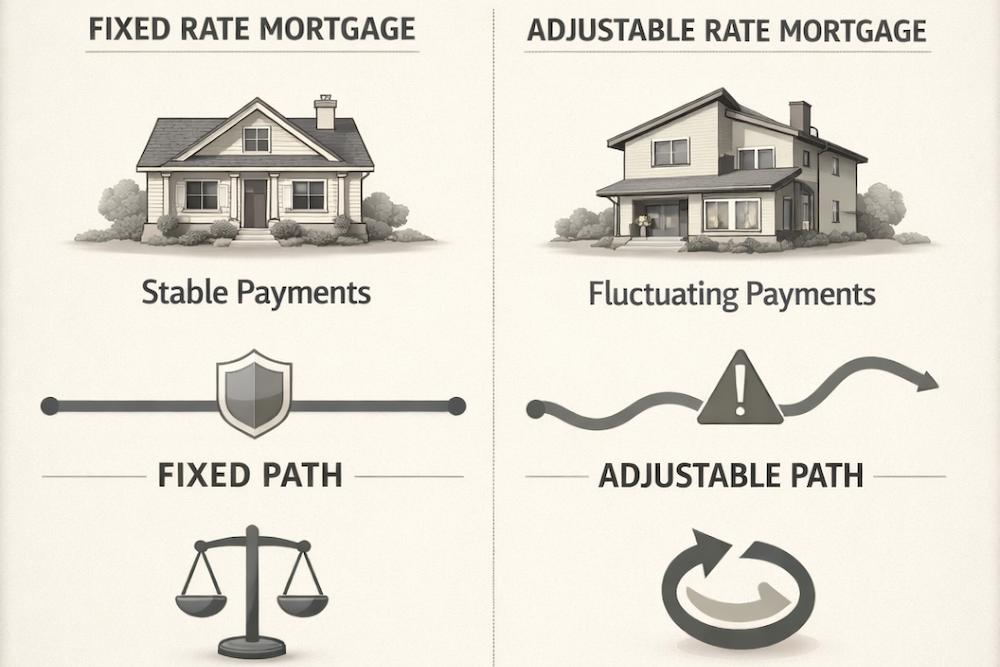

Your rent or mortgage payment protects your housing stability. Utility bills keep the lights on and water running. Grocery expenses ensure your family eats. Transportation costs—whether car payments, insurance, or public transit—get you to work. Missing payments on credit cards hurts your credit score. Losing your apartment puts you on the street. The choice becomes clear when you frame it this way.

Digital budgeting tools like Mint or YNAB (You Need A Budget) can help you visualize these priorities. These fintech solutions automatically categorize expenses and highlight where your money actually goes. Many millennials find that tracking spending through apps creates more awareness than traditional spreadsheets ever did.

Negotiating With Creditors Before You Fall Behind

Reaching out to creditors feels uncomfortable. Most people avoid these conversations until collection notices arrive. However, proactive communication often yields better results than waiting. Credit card companies, utility providers, and landlords generally prefer working with you rather than pursuing collections.

Call your creditors before you miss payments. Explain your situation honestly and ask about hardship programs. Many companies offer temporary payment reductions, deferred due dates, or modified payment plans. The key is making contact before your account becomes delinquent. Once you’ve missed multiple payments, your negotiating position weakens considerably.

Document everything during these conversations. Write down the representative’s name, date, and any agreements reached. Follow up with email confirmation when possible. Some creditors might request documentation of your financial hardship, such as pay stubs or termination letters. Having this paperwork ready speeds up the approval process for assistance programs.

Creating a Bare-Bones Budget

Strip your budget down to absolute necessities. Cancel subscription services you forgot existed. That $15 monthly streaming service adds up to $180 annually. Your gym membership might need to pause while you handle this crisis. Review your bank statements from the past three months and highlight every recurring charge.

Distinguish between needs and wants ruthlessly. You need internet for work and job searching. You don’t need the premium high-speed package. You need a phone. You don’t need unlimited data if WiFi covers most of your usage. These adjustments feel restrictive, but they’re temporary measures while you stabilize your finances.

Consider the cash envelope method for variable expenses like groceries and gas. Withdraw the budgeted amount in cash at the start of each week. When the envelope empties, you stop spending in that category. This physical limitation prevents the overspending that credit cards enable. Many people find that handling physical money creates more spending awareness than swiping cards.

Explore Financial Relief Programs and Resources

Federal and state governments offer numerous assistance programs that many eligible people never claim. The Supplemental Nutrition Assistance Program (SNAP) helps millions of Americans afford groceries. Eligibility extends further than many realize, especially for households with children or elderly members. The application process has moved largely online, making it more accessible than ever.

The Low Income Home Energy Assistance Program (LIHEAP) helps with heating and cooling costs. Many states also offer emergency rental assistance programs, particularly in the aftermath of pandemic-era protections. These programs received significant funding boosts in recent years, though availability varies by location. Check your state’s Department of Health and Human Services website for specific programs in your area.

Medicaid expansion in many states means more people qualify for health coverage. Medical bills represent a leading cause of financial distress in America. Securing health insurance prevents small health issues from becoming financial catastrophes. The Healthcare.gov marketplace also offers subsidies for those above Medicaid thresholds but still struggling financially.

Community Resources and Nonprofit Organizations

Local nonprofits often provide assistance that government programs don’t cover. Food banks have evolved beyond basic provisions to offer fresh produce and nutritious options. Many operate with dignity-centered models that feel more like grocery shopping than charity. Feeding America’s network includes over 200 food banks nationwide, serving millions of families.

Churches, synagogues, and other faith-based organizations frequently run emergency assistance funds. You typically don’t need to be a member to receive help. These organizations might cover utility bills, provide gas cards, or offer grocery vouchers. Community action agencies coordinate multiple services under one roof, helping you access various resources simultaneously.

211 is a nationwide hotline connecting people with local resources. Dial 211 from any phone to speak with specialists who know your area’s available assistance programs. This free service has helped millions navigate the complex landscape of social services. The 211 database includes everything from food assistance to mental health resources.

Leveraging Fintech Solutions for Short-Term Relief

The fintech revolution has created new options for managing cash flow crunches. Earned wage access apps like DailyPay or Earnin let you access wages you’ve already earned before payday. These services aren’t loans—they’re advances on your own money. They can help you avoid overdraft fees or late payment penalties.

Buy-now-pay-later services from companies like Affirm or Klarna allow you to split necessary purchases into smaller payments. Use these tools carefully and only for essentials. They can help you replace a broken appliance without derailing your entire budget. However, overuse creates the same debt spiral as credit cards.

Banking apps now offer features that previous generations lacked. Many banks provide early direct deposit, giving you access to paychecks up to two days early. Overdraft protection options have improved, with some banks eliminating fees entirely. Chime and other digital banks offer fee-free overdraft up to certain limits. These features won’t solve underlying income problems, but they provide breathing room while you implement longer-term solutions.

Building Long-Term Financial Resilience

Short-term crisis management must eventually transition to sustainable financial practices. Once you stabilize your immediate situation, focus on building an emergency fund. Start small—even $500 provides a buffer against unexpected expenses. Automate savings by setting up automatic transfers of $25 or $50 per paycheck.

Consider ways to increase income alongside cutting expenses. The gig economy offers flexible earning opportunities through platforms like Uber, DoorDash, or Upwork. Remote work has expanded possibilities for side hustles that fit around primary employment. Many millennials successfully combine multiple income streams to create financial stability.

Financial literacy resources have never been more accessible. Free courses through organizations like the National Financial Educators Council can strengthen your money management skills. YouTube channels, podcasts, and blogs offer practical advice without the cost of traditional financial advisors. Investing time in financial education pays dividends throughout your life.

When bills outpace paychecks, the stress feels overwhelming. However, taking strategic action puts you back in the driver’s seat. Prioritize ruthlessly, communicate with creditors, and tap into available resources. Government programs, community organizations, and modern fintech tools offer more options than ever before. Remember that financial setbacks don’t define you—they’re temporary challenges that millions of Americans face. The key is responding proactively rather than avoiding the problem. Start with one action today, whether that’s calling a creditor, applying for assistance, or downloading a budgeting app. Small steps accumulate into meaningful progress. Your financial situation can improve, but only if you take that first step toward change.

References

- LendingClub Corporation. (2023). “Reality Check: Paycheck-to-Paycheck Research.” LendingClub. https://www.lendingtree.com/

- USDA Food and Nutrition Service. (2024). “Supplemental Nutrition Assistance Program (SNAP).” U.S. Department of Agriculture. https://www.fns.usda.gov/snap

- Consumer Financial Protection Bureau. (2024). “Managing Your Bills and Expenses.” CFPB. https://www.consumerfinance.gov/

You open your mailbox and your stomach drops. Another stack of bills awaits. Meanwhile, your checking account balance tells a different story—one where your paycheck disappeared days ago. If this scenario sounds familiar, you’re not alone. A 2023 LendingClub report found that 60% of Americans live paycheck to paycheck, struggling to keep up with mounting expenses. The gap between income and obligations has widened significantly, especially as inflation drives up costs for everything from groceries to rent. But falling behind doesn’t mean you’re out of options. Strategic planning and smart resource allocation can help you regain control of your finances, even when the numbers don’t seem to add up.

Take Control: Prioritize Your Bills Strategically

When money runs short, not all bills deserve equal attention. Financial experts recommend the “four walls” approach: food, shelter, utilities, and transportation. These essentials keep you alive, housed, and able to work. Everything else comes second. This might sound harsh, but prioritization becomes crucial when resources dwindle.

Your rent or mortgage payment protects your housing stability. Utility bills keep the lights on and water running. Grocery expenses ensure your family eats. Transportation costs—whether car payments, insurance, or public transit—get you to work. Missing payments on credit cards hurts your credit score. Losing your apartment puts you on the street. The choice becomes clear when you frame it this way.

Digital budgeting tools like Mint or YNAB (You Need A Budget) can help you visualize these priorities. These fintech solutions automatically categorize expenses and highlight where your money actually goes. Many millennials find that tracking spending through apps creates more awareness than traditional spreadsheets ever did.

Negotiating With Creditors Before You Fall Behind

Reaching out to creditors feels uncomfortable. Most people avoid these conversations until collection notices arrive. However, proactive communication often yields better results than waiting. Credit card companies, utility providers, and landlords generally prefer working with you rather than pursuing collections.

Call your creditors before you miss payments. Explain your situation honestly and ask about hardship programs. Many companies offer temporary payment reductions, deferred due dates, or modified payment plans. The key is making contact before your account becomes delinquent. Once you’ve missed multiple payments, your negotiating position weakens considerably.

Document everything during these conversations. Write down the representative’s name, date, and any agreements reached. Follow up with email confirmation when possible. Some creditors might request documentation of your financial hardship, such as pay stubs or termination letters. Having this paperwork ready speeds up the approval process for assistance programs.

Creating a Bare-Bones Budget

Strip your budget down to absolute necessities. Cancel subscription services you forgot existed. That $15 monthly streaming service adds up to $180 annually. Your gym membership might need to pause while you handle this crisis. Review your bank statements from the past three months and highlight every recurring charge.

Distinguish between needs and wants ruthlessly. You need internet for work and job searching. You don’t need the premium high-speed package. You need a phone. You don’t need unlimited data if WiFi covers most of your usage. These adjustments feel restrictive, but they’re temporary measures while you stabilize your finances.

Consider the cash envelope method for variable expenses like groceries and gas. Withdraw the budgeted amount in cash at the start of each week. When the envelope empties, you stop spending in that category. This physical limitation prevents the overspending that credit cards enable. Many people find that handling physical money creates more spending awareness than swiping cards.

Explore Financial Relief Programs and Resources

Federal and state governments offer numerous assistance programs that many eligible people never claim. The Supplemental Nutrition Assistance Program (SNAP) helps millions of Americans afford groceries. Eligibility extends further than many realize, especially for households with children or elderly members. The application process has moved largely online, making it more accessible than ever.

The Low Income Home Energy Assistance Program (LIHEAP) helps with heating and cooling costs. Many states also offer emergency rental assistance programs, particularly in the aftermath of pandemic-era protections. These programs received significant funding boosts in recent years, though availability varies by location. Check your state’s Department of Health and Human Services website for specific programs in your area.

Medicaid expansion in many states means more people qualify for health coverage. Medical bills represent a leading cause of financial distress in America. Securing health insurance prevents small health issues from becoming financial catastrophes. The Healthcare.gov marketplace also offers subsidies for those above Medicaid thresholds but still struggling financially.

Community Resources and Nonprofit Organizations

Local nonprofits often provide assistance that government programs don’t cover. Food banks have evolved beyond basic provisions to offer fresh produce and nutritious options. Many operate with dignity-centered models that feel more like grocery shopping than charity. Feeding America’s network includes over 200 food banks nationwide, serving millions of families.

Churches, synagogues, and other faith-based organizations frequently run emergency assistance funds. You typically don’t need to be a member to receive help. These organizations might cover utility bills, provide gas cards, or offer grocery vouchers. Community action agencies coordinate multiple services under one roof, helping you access various resources simultaneously.

211 is a nationwide hotline connecting people with local resources. Dial 211 from any phone to speak with specialists who know your area’s available assistance programs. This free service has helped millions navigate the complex landscape of social services. The 211 database includes everything from food assistance to mental health resources.

Leveraging Fintech Solutions for Short-Term Relief

The fintech revolution has created new options for managing cash flow crunches. Earned wage access apps like DailyPay or Earnin let you access wages you’ve already earned before payday. These services aren’t loans—they’re advances on your own money. They can help you avoid overdraft fees or late payment penalties.

Buy-now-pay-later services from companies like Affirm or Klarna allow you to split necessary purchases into smaller payments. Use these tools carefully and only for essentials. They can help you replace a broken appliance without derailing your entire budget. However, overuse creates the same debt spiral as credit cards.

Banking apps now offer features that previous generations lacked. Many banks provide early direct deposit, giving you access to paychecks up to two days early. Overdraft protection options have improved, with some banks eliminating fees entirely. Chime and other digital banks offer fee-free overdraft up to certain limits. These features won’t solve underlying income problems, but they provide breathing room while you implement longer-term solutions.

Building Long-Term Financial Resilience

Short-term crisis management must eventually transition to sustainable financial practices. Once you stabilize your immediate situation, focus on building an emergency fund. Start small—even $500 provides a buffer against unexpected expenses. Automate savings by setting up automatic transfers of $25 or $50 per paycheck.

Consider ways to increase income alongside cutting expenses. The gig economy offers flexible earning opportunities through platforms like Uber, DoorDash, or Upwork. Remote work has expanded possibilities for side hustles that fit around primary employment. Many millennials successfully combine multiple income streams to create financial stability.

Financial literacy resources have never been more accessible. Free courses through organizations like the National Financial Educators Council can strengthen your money management skills. YouTube channels, podcasts, and blogs offer practical advice without the cost of traditional financial advisors. Investing time in financial education pays dividends throughout your life.

When bills outpace paychecks, the stress feels overwhelming. However, taking strategic action puts you back in the driver’s seat. Prioritize ruthlessly, communicate with creditors, and tap into available resources. Government programs, community organizations, and modern fintech tools offer more options than ever before. Remember that financial setbacks don’t define you—they’re temporary challenges that millions of Americans face. The key is responding proactively rather than avoiding the problem. Start with one action today, whether that’s calling a creditor, applying for assistance, or downloading a budgeting app. Small steps accumulate into meaningful progress. Your financial situation can improve, but only if you take that first step toward change.

References

- LendingClub Corporation. (2023). “Reality Check: Paycheck-to-Paycheck Research.” LendingClub. https://www.lendingtree.com/

- USDA Food and Nutrition Service. (2024). “Supplemental Nutrition Assistance Program (SNAP).” U.S. Department of Agriculture. https://www.fns.usda.gov/snap

- Consumer Financial Protection Bureau. (2024). “Managing Your Bills and Expenses.” CFPB. https://www.consumerfinance.gov/